39+ Income driven repayment plan calculator

An Income-Contingent Repayment ICR is an income-driven repayment option offered by the government for federal student loans. They are a great option.

Pin On Get Yo Shit Together

With our free income-based repayment plan calculator you can see if you are eligible for a lower monthly payment.

. Your new monthly payment will be dependent on factors such as income. Find Your Path To Student Loan Freedom. This is where the governments calculator stops and this is why so many people make the mistake of going on income driven repayment plans to begin with.

With an annual income. Updated 2022 federal poverty data used to calculate your monthly discretionary income. Payment would be on an IBR plan.

This student loan Income-Contingent Repayment ICR calculator shows your monthly payment monthly savings and student loan forgiveness for the ICR plan. More affordable repayment formula. Pay As You Earn PAYE 10 of discretionary income.

Finally multiply your discretionary income by 015 then divide that number by 12 to get your monthly REPAYE Plan payment. Income-Driven Repayment IDR Calculator. An income-driven repayment plan sets your monthly student loan payment at an amount that is intended to be affordable based on your income and family size.

Switching to IBR would lower your current monthly student loan payment to 183 which is 213 lower than your current payment. Some income-driven repayment plans partially subsidize interest costs. Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt.

Using the same numbers from the example above. The payment will never be more than the amount you would pay under the 10-year Standard Repayment Plan. This program will generally limit payments to 20 of.

739 299 - 993 299 -. However your servicer will use a family size of one to calculate these amounts. We offer four income-driven.

Some income-driven repayment plans partially subsidize interest costs. Free 39 Estimate Forms In Pdf Ms Word Multiply your discretionary income by 010 to get 46150. The mistake is that they.

If you have more student loan debt than you can handle you might qualify for income-based repayment IBR. Income-Driven Repayment IDR plans can cap your required monthly payments in proportion to your discretionary income. Current IDR plans base the monthly payments off of a percentage of the borrowers discretionary income the amount of AGI above the.

If you choose the IBR plan your monthly student loan payment would be 149 which is 406 lower than your current monthly payment. Our calculator model includes all of the most common IBR details including. This is where the governments calculator stops and this is why so many people make the mistake of going on income driven repayment plans to begin with.

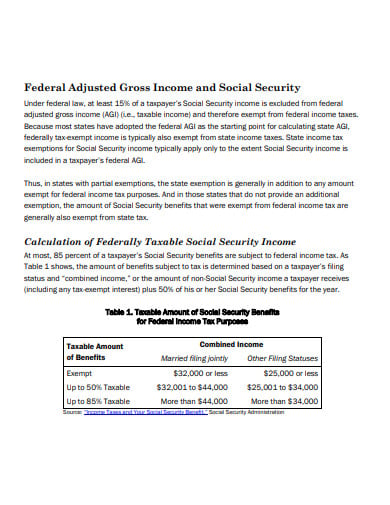

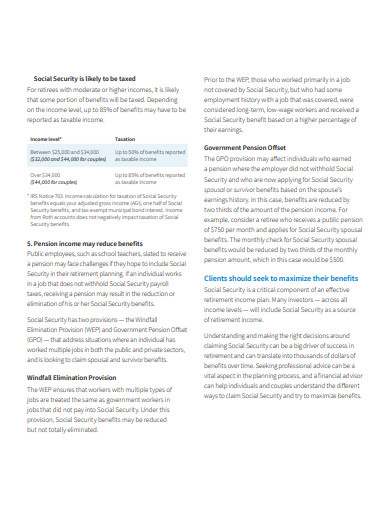

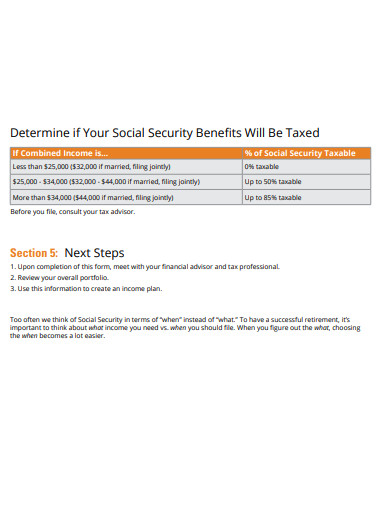

11 Social Security Income Calculator Templates In Pdf Free Premium Templates

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

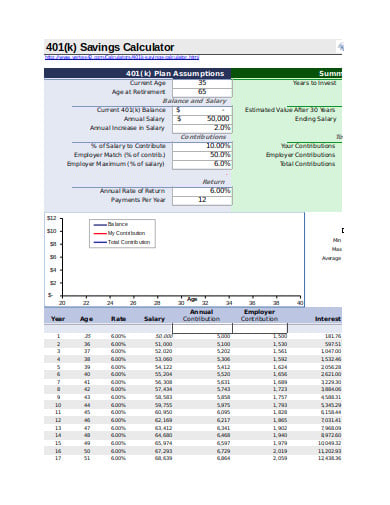

6 401k Calculator Templates In Xls Free Premium Templates

107 Ways To Pay Off Your Student Loans Student Loan Planner

11 Social Security Income Calculator Templates In Pdf Free Premium Templates

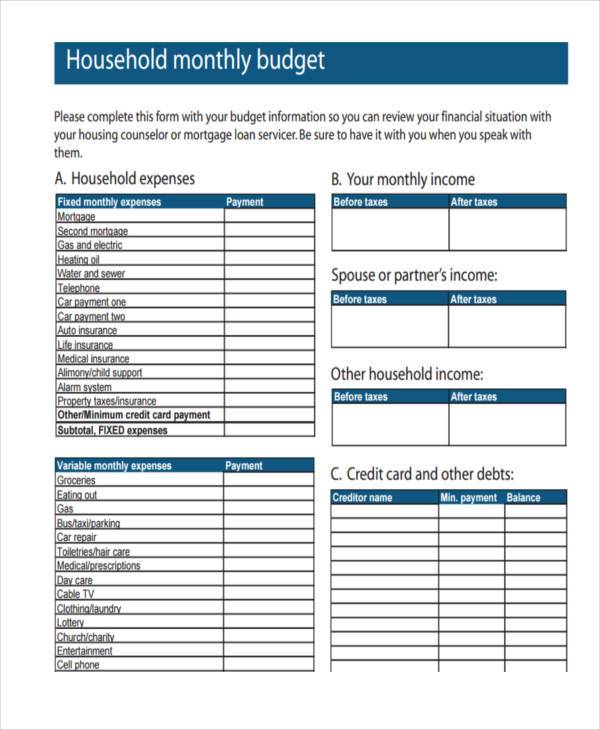

Pin On Budget

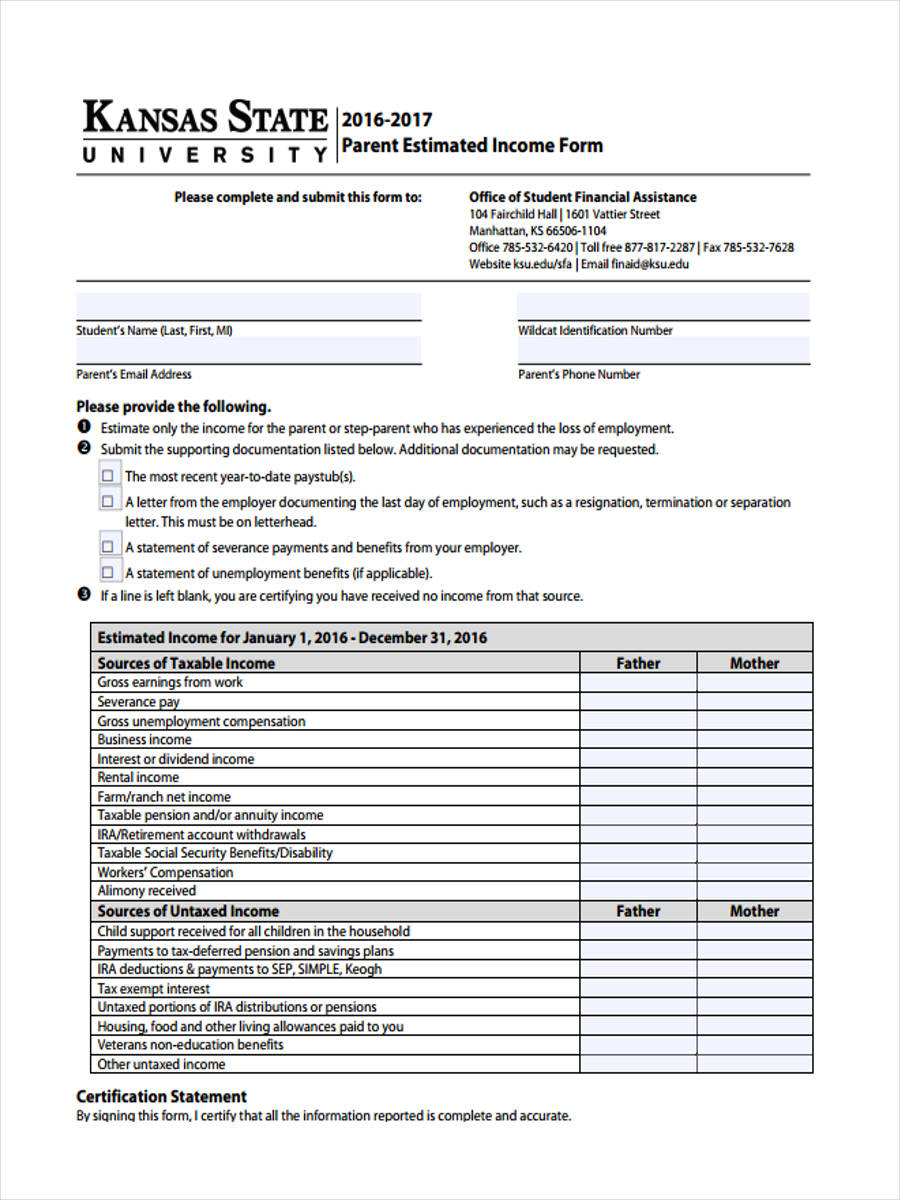

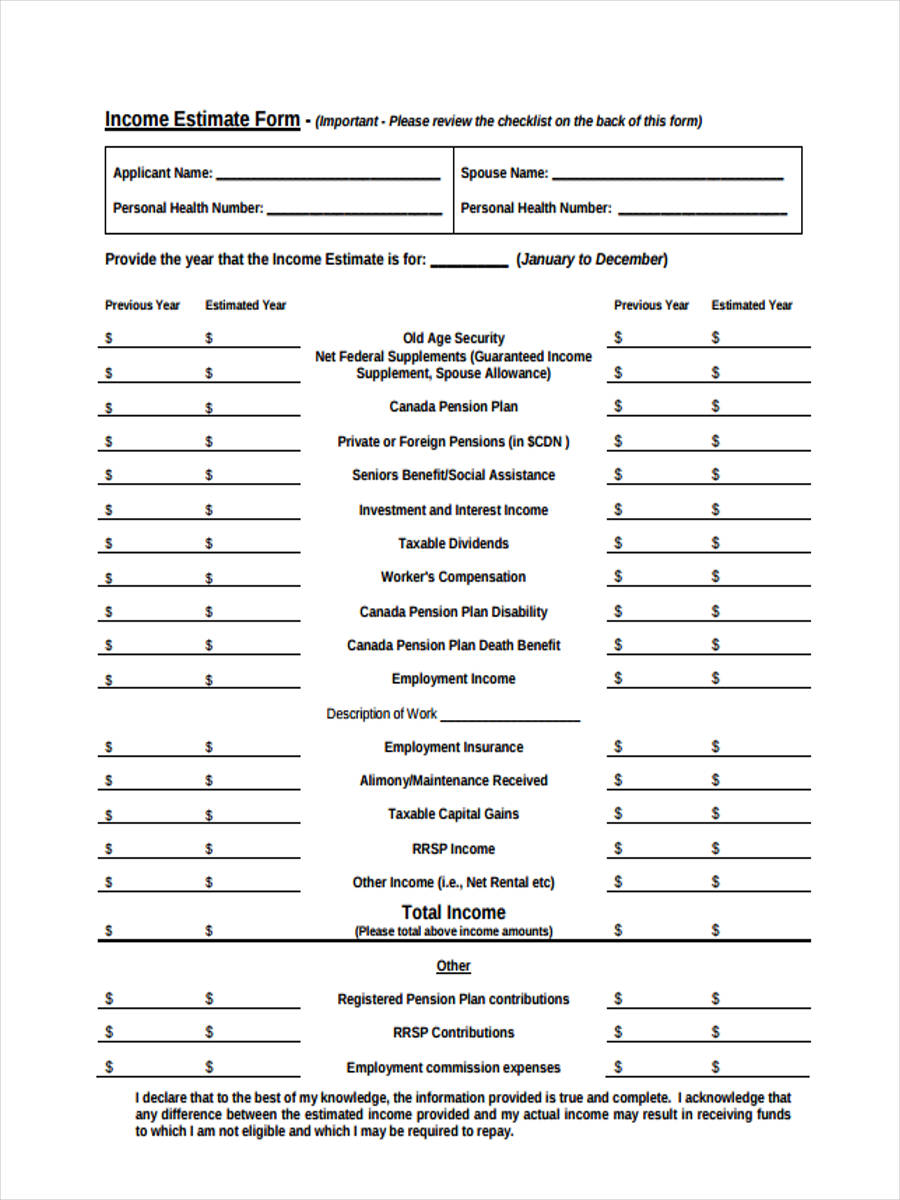

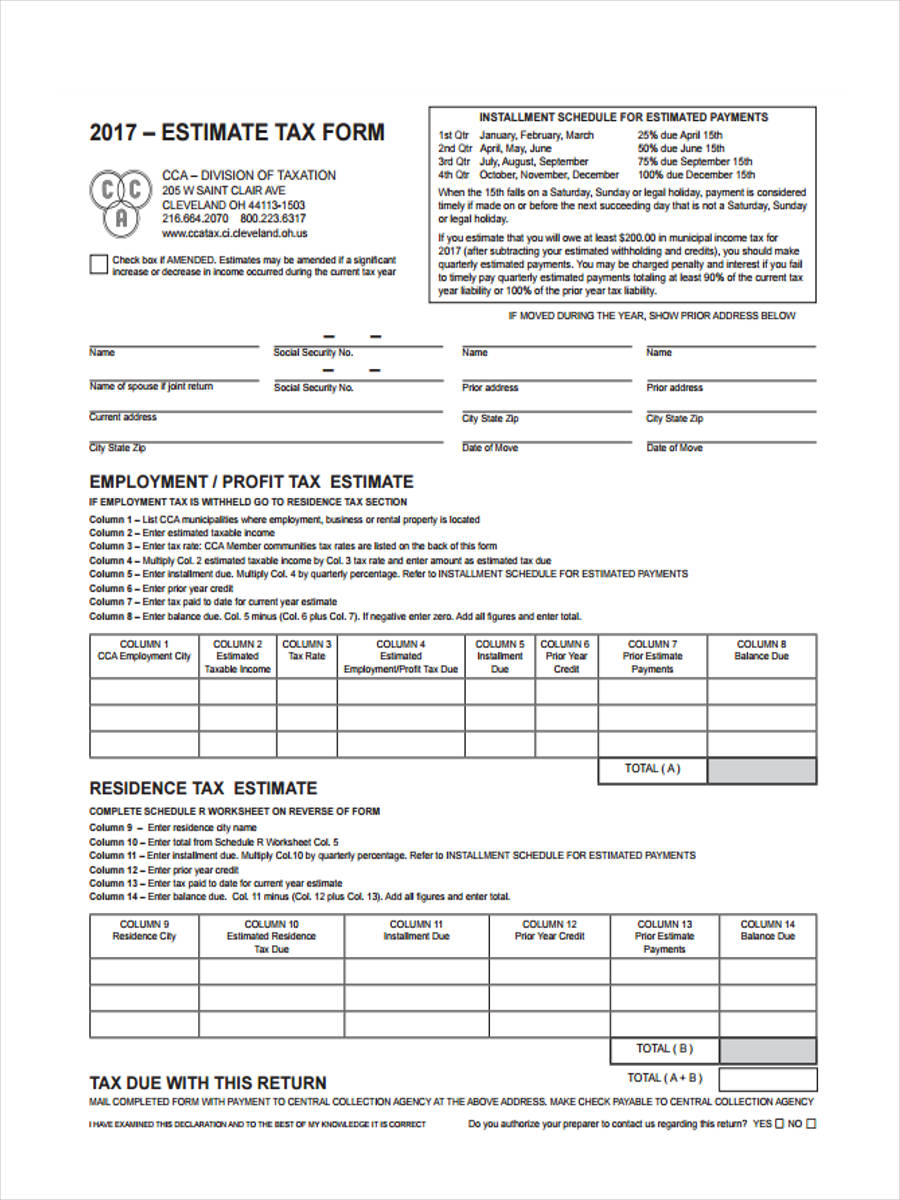

Free 39 Estimate Forms In Pdf Ms Word

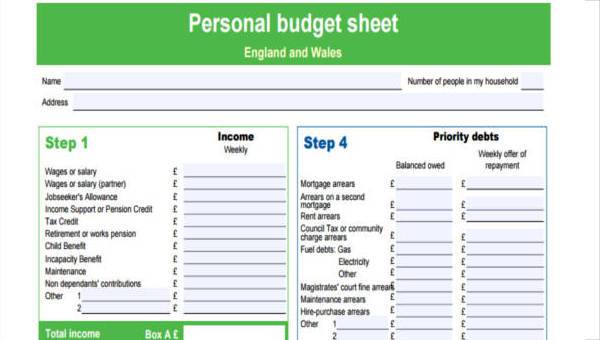

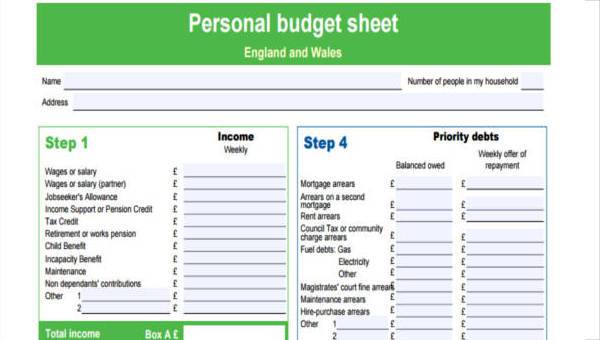

Free 39 Sample Budget Forms In Pdf Excel Ms Word

Pin On Money

11 Social Security Income Calculator Templates In Pdf Free Premium Templates

11 Social Security Income Calculator Templates In Pdf Free Premium Templates

Free 39 Sample Budget Forms In Pdf Excel Ms Word

Free 39 Estimate Forms In Pdf Ms Word

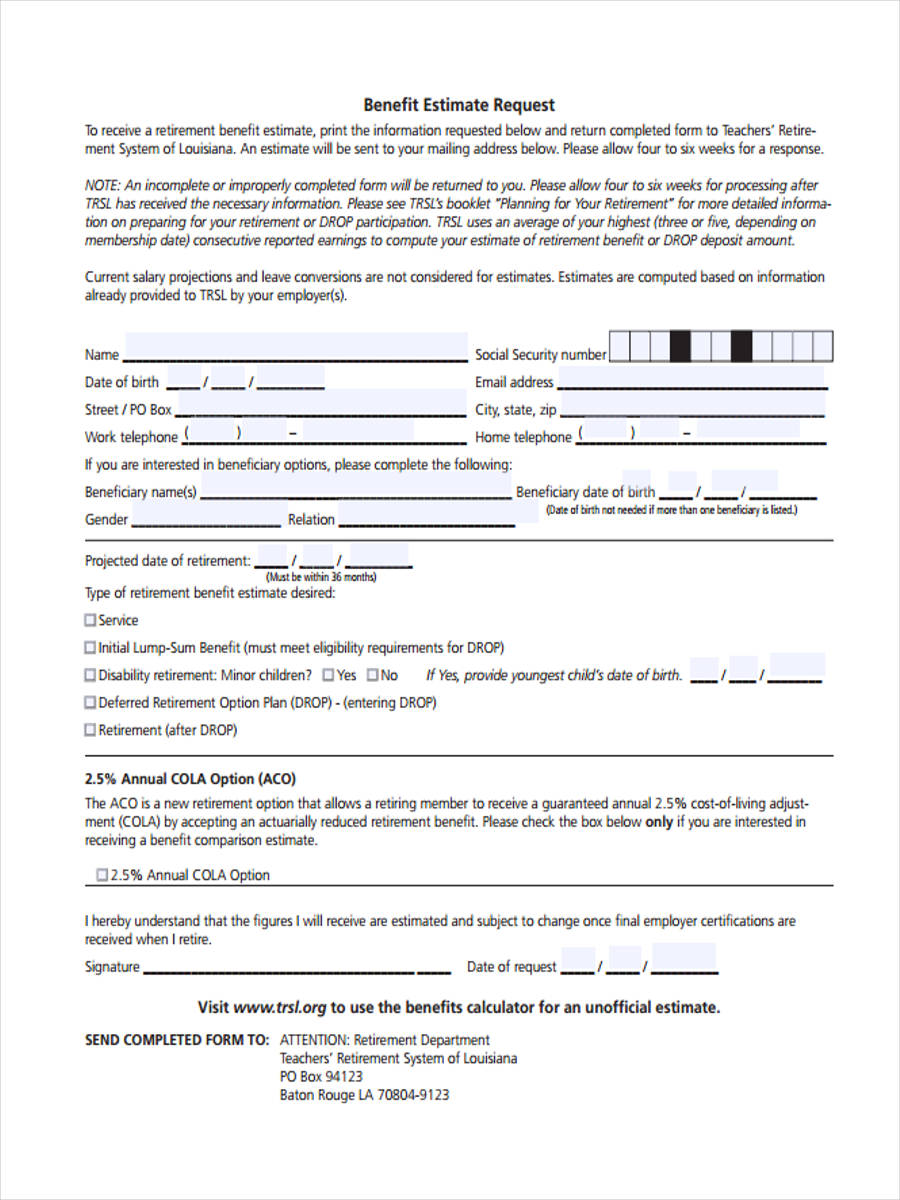

9 Retirement Calculator Templates In Pdf Doc Free Premium Templates

Free 39 Estimate Forms In Pdf Ms Word

9 Retirement Calculator Templates In Pdf Doc Free Premium Templates

Free 39 Estimate Forms In Pdf Ms Word